Have you ever heard the phrase “sharpen the saw” from Stephen Covey’s book The 7 Habits of Highly Effective People? Well, the best way to sharpen the saw is to continue growing and never stop learning.

When we talk about becoming financially literate, its imperative to invest in knowledge. It’s actually the first step before you make any financial decisions and investing your hard-earned money.

Investment in knowledge comes in the form of attending related seminars and workshops, having great financial coaches or mentors, and reading a lot of books. In fact, successful people like Warren Buffet reportedly spends about 80 percent of his day reading, Bill Gates reads about 50 books per year, which breaks down to one per week, and Oprah Winfrey selects one of her favorite books every month for her Book Club members to read and discuss.

Successful people tend to choose educational books and publications over novels, tabloids, and magazines. In other words, reading books is one way to sharpen the saw.

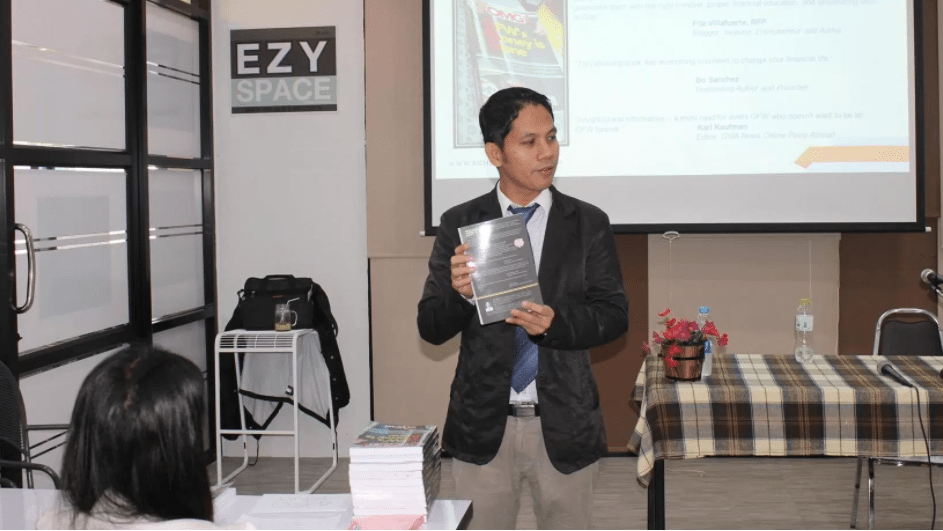

When was the last time you sharpened your axe? If you want to improve in terms of financial management, let me share with you the reasons why you should read my latest book “OMG! OFW’s Money is Gone: Practical Tips On How to Be Wise With Your Hard-earned Money.”

1. OMG book is practical and easy to understand

OMG discusses some of the personal and real-life stories of many OFWs. In addition, I have included my financial journey before and after coming to work in Thailand to inspire the readers. My financial struggle will be an inspiration for you not to give up your dreams and help your loved ones.

2. OMG book presents the life and challenges of many ordinary OFWs

OFWs have been considered as modern day hero because of their commitment and dedication to help the family. In this book, I have discussed the challenges and financial condition of many OFWs such as not being unprepared for emergency situations, debt, investment opportunities, retirement, and many more.

3. OMG book offers tons of information about improving your finances

The struggle is real in terms of money management. Because the cost of financial ignorance is quite high, financial education is important to improve the quality of one‘s life. The tips I have offered in the book are quite practical and easy to understand. Although written primarily for OFWs, the book is definitely worthy to read even if you are not an OFW.

4. Highly recommended by best-selling authors in personal finance

Bro. Bo Sanchez and Fitz Villafuerte are just a few example of personal finance experts and best selling author in the Philippines. Before you read my book, they were the first who read my manuscript. This is what they say:

“This book is both an educational and heartwarming read. Through his own life story, Jun will tell you all about thefinancial struggles of an OFW; and how he was able to overcome them with the right mindset, proper financial education, and unwavering faith in God.” — Fitz Villafuerte,Registered Financial Planner

“This amazing book has everything you need to change your financial life.” — Bo Sanchez, Best-selling Author

“In this book, Jun Amparo generously shares his knowledge and experiences in the hope of helping his fellow OFWs become good stewards of money.” — Rose Fres Fausto FQ Mom, Author and Speaker

“Insightful and informative — a must read for every OFW who doesn’t want to be an OFW forever.” — Karl Kaufman Editor, GMA News Online Pinoy Abroad

“JUN writes from his heart. This is an important element in this book. Most personal finance books are for general audiences, this one is written for the millions of Overseas Filipino Heroes. I entreat you to journey with Jun in learning and unlearning traits and habits in regard to making your purpose as an OFW a fruitful one. This journey will also make you a responsible steward of God’s blessings for more to come.” — Dr. Alvin Ang Professor of Economics, Ateneo De Manila University

In addition, some OFWs from different countries like Japan, Qatar, Canada, Israel, Turkey, Saudi Arabia, and the U.S. have read the OMG book.

5. OMG book presents Christian approach to money management

What makes the OMG book unique compared with other personal finance books have to offer? The answer is I have emphasized trusting God’s providence. Why? I believe it’s essential to recognize God as the Source of all blessings we received.

Jun Amparo is a personal finance advocate and founder of Richly Blessed Today. He is an OFW currently working as a school counselor in an international school in Thailand. He is the author of “OMG! OFW’s Money is Gone: Practical Tips on How to Be Wise with Your Hard-earned Money.” To get a copy of his book, please visit his blog, www.richlyblessedtoday.com